Knowledge

Jan 30, 2025

Why the cap table is not enough for shareholder management

Joel Hoff

Account Executive

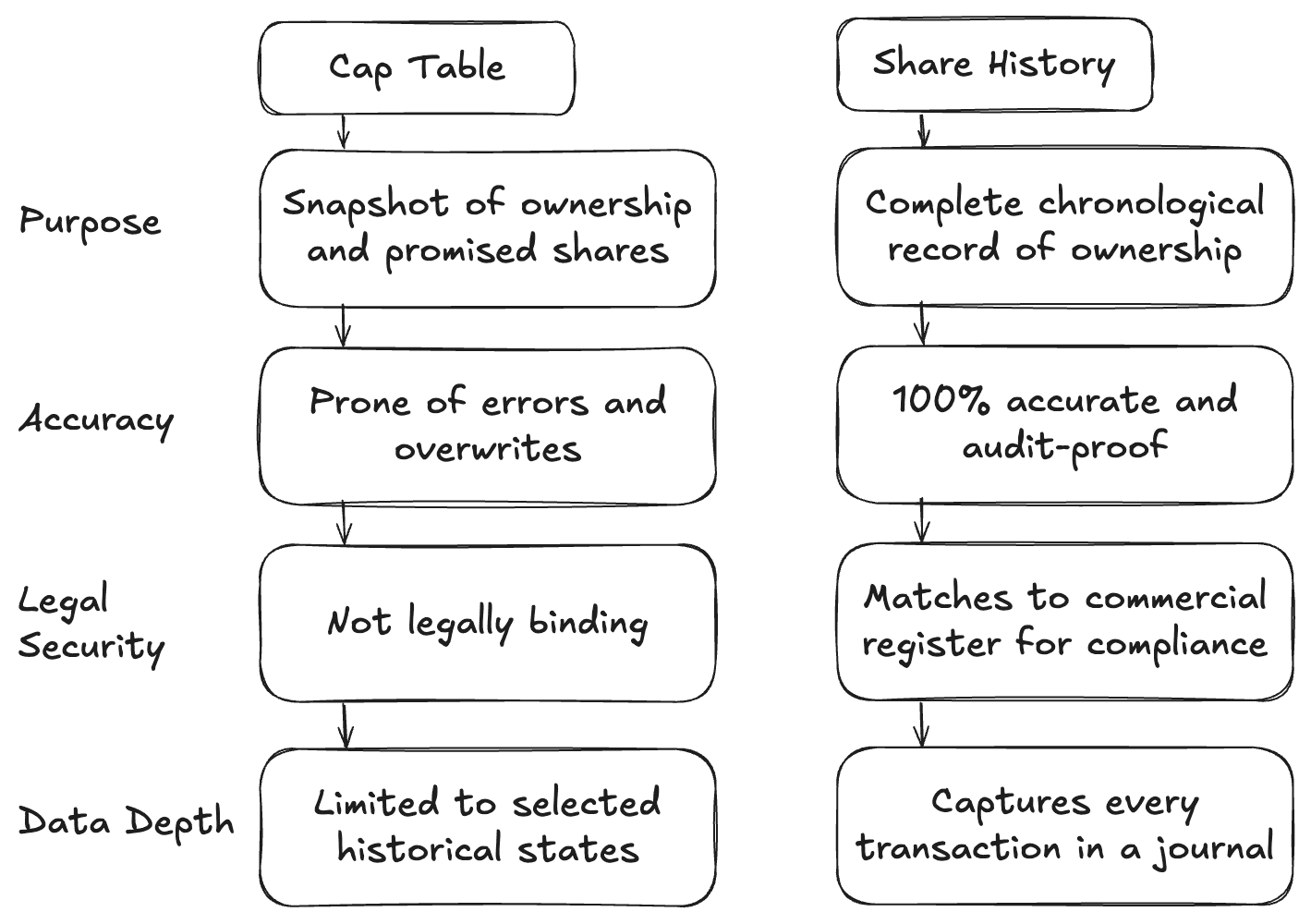

For startups and companies of any size, accurately managing ownership rights is essential. Many founders rely on cap tables, but they may not realize the limitations of this tool. To manage ownership rights effectively and securely, a comprehensive share history is the better solution. In this article, we’ll explore the differences between cap tables and share histories, and explain why adopting a digital share register for ownership management can save you time and headaches down the road.

What is a Cap Table?

A cap table is a spreadsheet or software-based tool that represents a company’s ownership structure. Typically, it includes a breakdown of who owns what—covering founders, investors, and other stakeholders.

Cap tables are particularly useful for understanding historical ownership structures, comparing changes over time, and tracking potential dilution. They often include the following information:

Ownership shares of founders and investors

Outstanding convertible loans

Outstanding option plans, such as ESOPs or PSOPs

Fully diluted ownership structures over time

While cap tables are informative snapshots of ownership, they are just that—snapshots. They are not designed to capture every transaction or provide a comprehensive, audit-proof record. Essentially, a cap table is like “Excel on steroids,” prone to errors, manual overwrites, and incomplete histories.

What is a Share History?

A share history is the complete, chronological record of all transactions that reflect a company’s ownership structure. It serves as the “golden record” of ownership, ensuring that every detail aligns with the commercial register.

The share history includes:

A 100% accurate, audit-proof journal of all transactions

Compliance and legal certainty by matching the commercial register

The ability to generate exports such as share registers, cap tables, or address lists

Maintaining a share history as a centralized journal provides unparalleled transparency and legal security. It minimizes the risk of manual errors and ensures no transaction is lost or overwritten.

Why a Share History is the right tool for ownership management:

Cap tables are great for high-level overviews and decision-making, but they cannot match the reliability and precision of a share history. For managing ownership rights, a centralized and complete record of all transactions is indispensable.

A centralized share history in the form of a journal offers the following advantages:

Legal Security: By aligning with the commercial register, you reduce the risk of compliance issues.

Time Savings: An audit-proof system eliminates the need for manual transaction verification.

Increased Accuracy: The system ensures an immutable audit trail.

Easy Data Export: A clean share history in journal form allows for automated generation of exports, such as cap tables or share registers.

Using a digital tool to manage the share history and generate cap tables automatically can significantly reduce administrative workload.

How is the cap table derived from the share history?

The share history is based on a chronological journal that records all corporate actions and transactions in accordance with the commercial register.

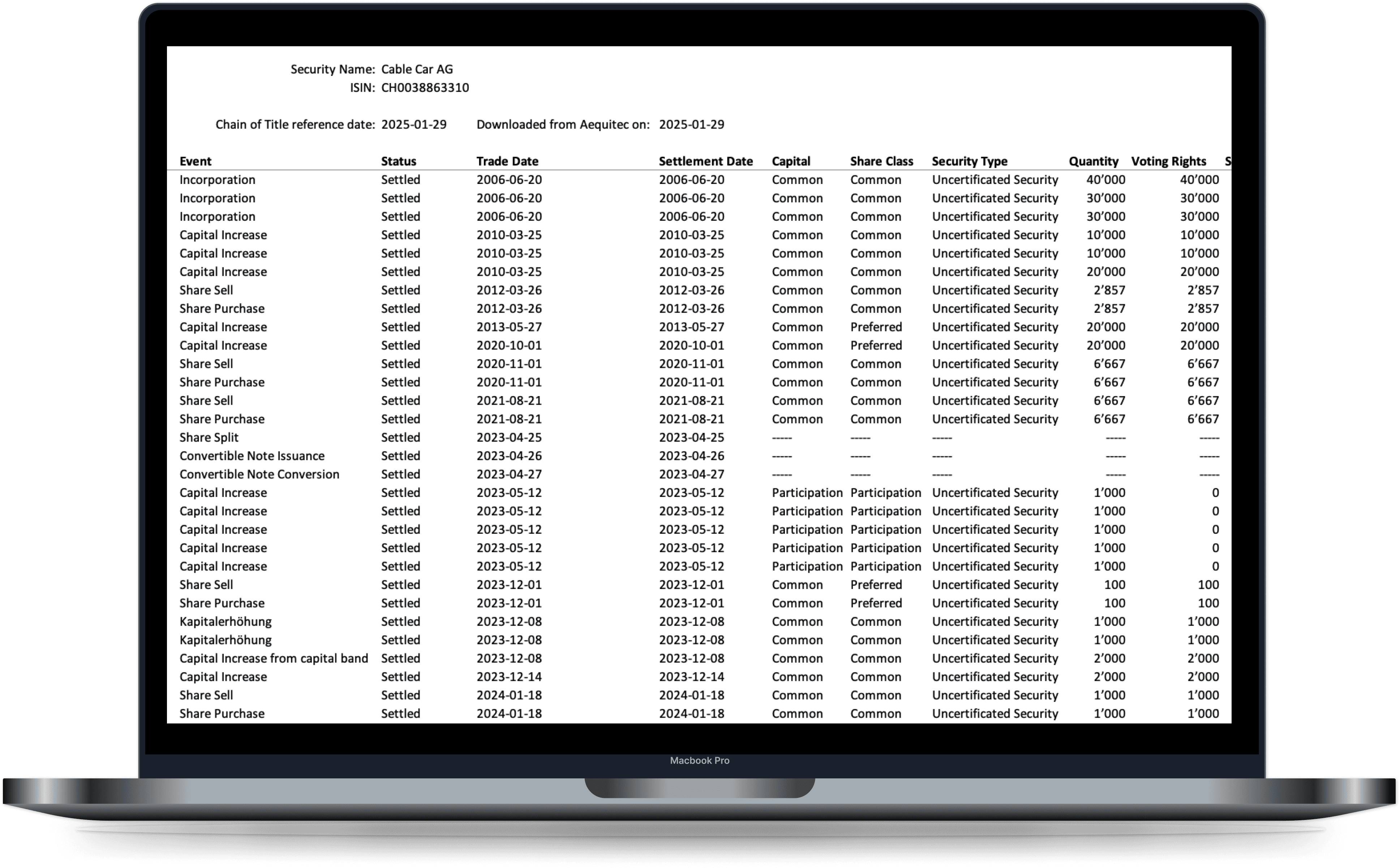

Example of an extract from a share history:

Based on this journal, it is possible to generate historical statuses. For this purpose, all transactions up to a selected date are included, and the resulting ownership status is generated for the selected date.

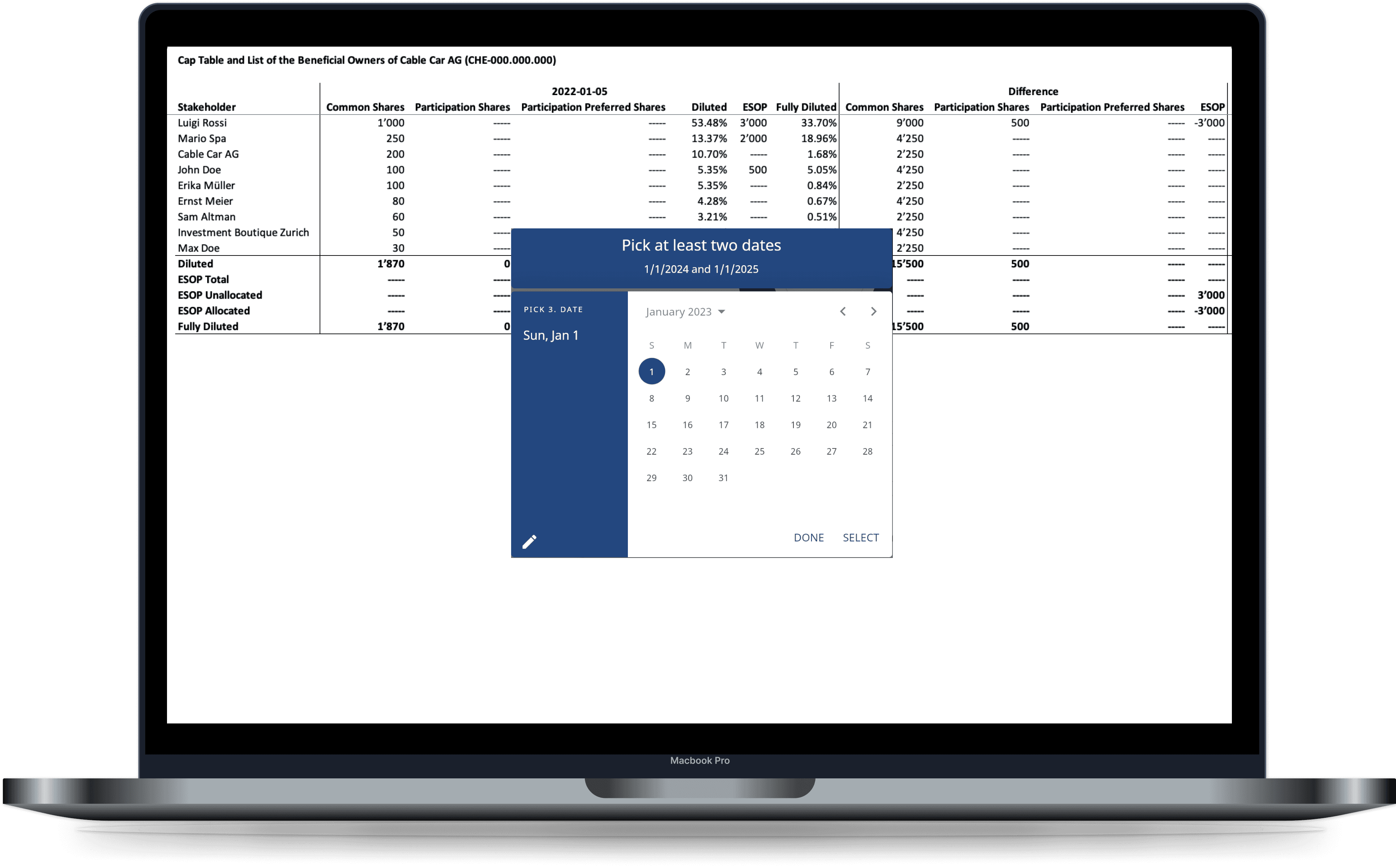

The cap table goes even further by comparing not just one, but several historical interim statuses with each other. In addition, the cap table can be used to map and simulate the dilution of outstanding shares through convertible loans, employee options or phantom shares.

Example of an extract from a cap table with selection of historical intermediate values:

With a modern share register tool, time-consuming cap table updates are a thing of the past, as the cap table can be generated at the click of a button based on the share history data at any historical state.

Conclusion

In wrapping up, while a cap table offers a handy high-level view of ownership, it simply cannot replace a detailed, transaction-by-transaction share history when it comes to precision, compliance and audit-readiness. By maintaining a comprehensive share history, ideally through a digital system that feeds into your cap table, you ensure legal security, more efficient operations and cleaner data for decision-making. In short: use your cap table for insight, but rely on your share history for certainty.